Fundametrics® Smid Cap Equity

Q4 2021 Performance Summary and Observations

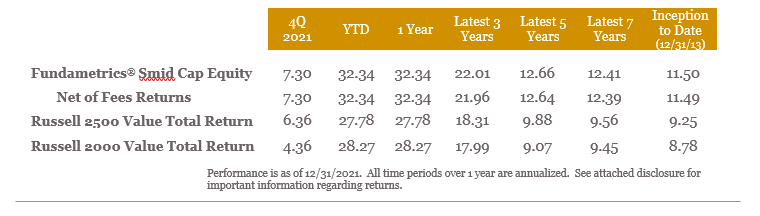

- The Fundametrics® Smid Cap Value strategy returned 7.30% for the quarter, beating the Russell 2500 Value Index’s return of 6.36%.

- Smid Cap Value as an asset class emerged as the leader for 2021 beating out Russell Large Cap indexes and dominating Smid Cap Growth. The Russell 2500 Value Index beat the Russell 2500 Growth by over 2200 bps!

- Omicron initially derailed the smid-cap upside break out of the 3rd Expectations are that Omicron is less severe and the economy will be able to bounce back quickly. With continued strong economic growth, the most likely path for interest rates is higher from current levels, a scenario historically favoring smid-cap stocks.

- The mainstays of the Fundametrics research process were positive for the quarter. The Alpha Composite “Buy” rated stocks beat “Sell” rated stocks by 990 bps.

- Companies with strong fundamentals performed well during the quarter with the unprofitable growth group underperforming. This is evident in the factor leadership for the quarter, rewarding high quality, low valuation, and positive changes in estimates. Stocks with the highest valuation, low quality and high forecasted long-term growth lagged. If the path of interest rates is higher, this environment likely continues.

- Meme stocks currently do not carry as much weight in the Russell 2500 Value index as they do in the small cap indices but they still can exert outsized influence.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.