Welcome to CornerCap Institutional

For institutional consultants, plan sponsors and financial advisors looking for managers to fulfill a specific mandate within a broader portfolio, we offer our Fundametrics® equity strategies.

Our Guiding Principles

CornerCap is a boutique asset manager with deep institutional roots and an ingrained culture of doing what’s best for clients.

Philosophy

Minimize Bias and Emotion. Act on Measurable Fundamentals.Philosophy

Human emotion and bias detract from performance and measurable, bottom-up fundamentals provide consistent repeatable results.

Process

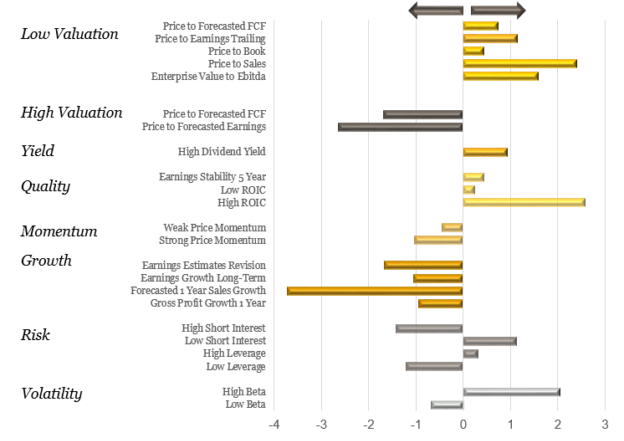

Fundametrics®Process

Proprietary Fundametrics® research system based on bottom-up, fundamental and quantifiable data. Consistent and repeatable application.

Strategies

Domestic and International EquityOwnership

100% Employee OwnedOwnership

Entirely owned by its employees: transparent succession plan for the next generation with founder still fully engaged.

2Q 2024 Fundametrics® Small Cap Commentary

Fundametrics® Small Cap Equity 2Q 2024 Performance Summary and Observations The Fundametrics® Small Cap Value strategy trailed its benchmark, the

2024 June Style Points

Featured: U.S. Large Cap Market continues to be dominated by a few names Artificial Intelligence (AI) stocks have better growth

2024 May Style Points

Featured: International Developed Small Cap A return to growth Markets returned to growth after April’s losses as investors anticipate major

White Paper: Tax-Efficient Equity Investing

By leveraging specific investment vehicles or accounts, taxable private client and institutional investors can minimize the impact of taxes on their wealth accumulation.

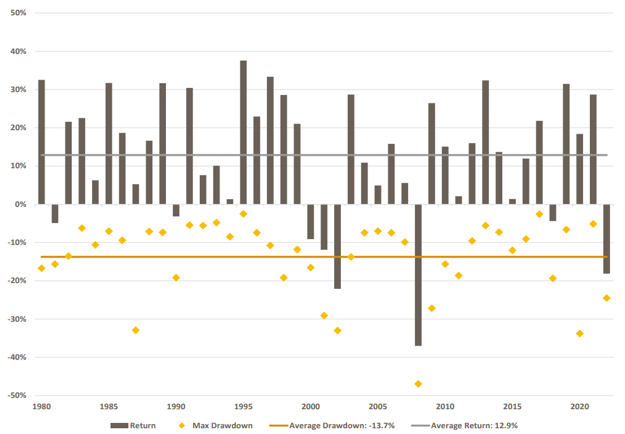

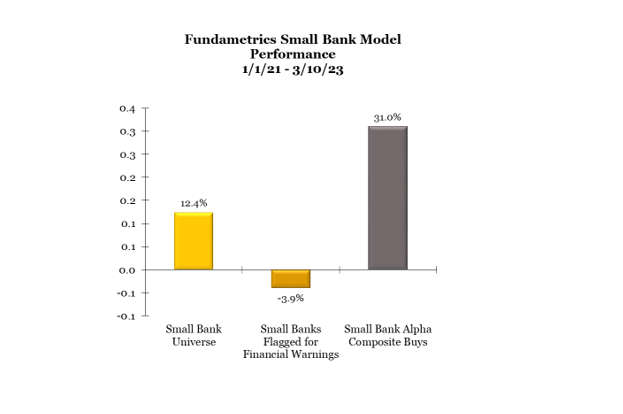

CornerCap’s Review of Bank Failures

We are often asked, how do we navigate our decisions in our Fundametrics research system during rare, outlier events? This paper provides real-time insight into that question in response to the collapse of Silicon Valley Bank in March 2023.

Manager of the Decade 2023

Manager of the Decade PSN Top Guns List 3rd Year in a Row CornerCap Institutional has been awarded a