Systematic Approach to Bottom-Up, Fundamental Investing

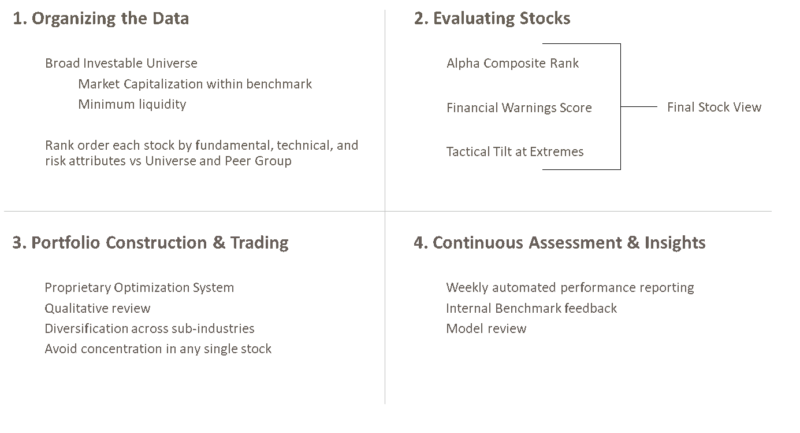

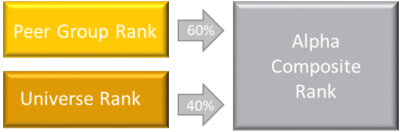

All of the CornerCap equity portfolios follow the same investment philosophy and investment process based on the firm’s Fundametrics® research system. The Fundametrics® investment process is a systematic approach to bottom-up, fundamental investing that identifies stocks with potential for alpha while identifying and avoiding stocks with characteristics that tend to exhibit underperfomance. It is highly efficient, repeatable and consistent in its application and can be applied across market caps and geographies.

Fundametrics® Research System

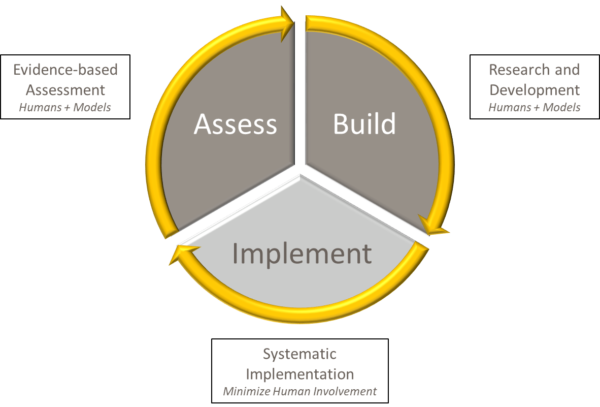

Investment Team Adds Value during “Build” and “Assess” Phase

Minimize Human Involvement during “Implementation”

Steps in the Investment Process

Competitive Advantages

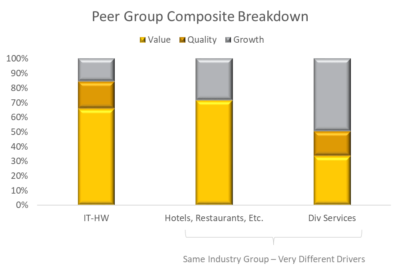

CornerCap Defined Peer Groups

Factors exhibit their own bias – which must be neutralized. CornerCap’s Fundametrics® models have over 30 peer groups that don’t necessarily follow GICS sector or industry conventions. Accurately defining peer groups improves factor efficacy and enhances stock selection.

Financial Warnings Overlay

Risk analysis as a separate step is important. Identifying and avoiding stocks with characteristics that tend to lead to underperformance adds value, especially for stocks that might otherwise be ranked highly by the Alpha Composite.

Constant R&D and

Real Time Historical Database

CornerCap has been gathering and storing fundamental and attribute data at the stock level since 2002 and even longer at the decile level. This real-time database provides a unique “sandbox” to test new factors and attributes based on information available at each particular point in time, minimizing back-testing bias.