Fundametrics® Smid Cap Equity

Q3 2021 Performance Summary and Observations

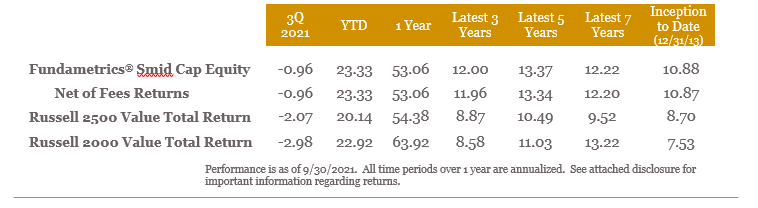

- The Fundametrics® Smid Cap Value strategy returned -0.96% for the quarter, beating the Russell 2500 Value Index’s return of -2.07%.

- The mainstays of the Fundametrics research process were positive for the quarter. The Alpha Composite “Buy” rated stocks beat “Sell” rated stocks by 417 bps. As anticipated, the overweight to long-term characteristics in the Alpha Composite were removed. This was due to moving past the pandemic’s impact on trailing fundamentals.

- Selection is the strength of the investment process, and it was positive in 8 out of 11 sectors.

- Like the 1st and 2nd quarters, markets oscillated between style extremes. Overall, the Fundametrics research process worked well, except for the four-week period ending September 10. This period corresponded with the rise and peak in Covid cases. Leadership during this period came from unprofitable / negative free cash flow generators and companies with long-term growth and high short interest.

- Russell reconstitution resulted in changes to the Russell 2500 Value. Healthcare, Consumer Discretionary and Real Estate were impacted the most with their weights changing by more than 200 bps each.

- Smid-cap stocks finished the quarter strong and have momentum into the last quarter. With continued strong economic growth, the most likely path for interest rates continues to be higher from current levels, a scenario historically favoring smid-cap stocks.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.