CornerCap’s Review of Bank Failures

Fundametrics® research implications in real-time

How does a quant model adjust during rare, outlier events?

Over the weekend of March 11-12, the CornerCap investment team actively monitored the fallout of the collapse of Silicon Valley Bank (SIVB), the second largest bank failure in US history. We are often asked, how do we navigate our decisions in our Fundametrics research system during those rare, outlier events? This paper provides real-time insight into that question.

For context, CornerCap’s Fundametrics investment process follows what we refer to as a “Build-Implement-Assess” loop. It is iterative by intention. The team builds the models and assesses their output on a regular schedule, allowing the model to implement without bias or human intervention. However, disruptive events occur (i.e. GFC in 2008, Pandemic in 2020, bank failures in 2023, etc.) that require us to learn, adapt and refine the models outside of the normal cadence.

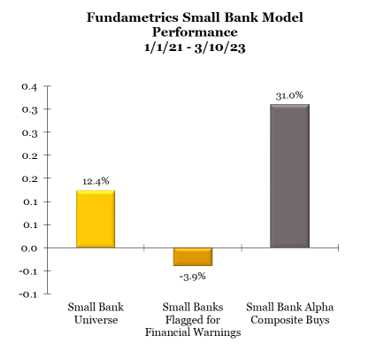

Using a series of charts and discussion, we demonstrate how the investment team initially assisted the Fundametrics research process. It will give you a sense of how we adapt, how our research process works, and why we believe in it deeply.

Access the FULL REPORT.

Contact Derek Tubbs at CornerCap Institutional with any questions at dtubbs@cornercap.com or 404-445-5117.