CornerCap Institutional Research

Improving Portfolios with Small-Cap Value

- Investors’ experience of the past ten years—when large stocks beat small and large-cap growth has dominated—runs counter to historical lessons.

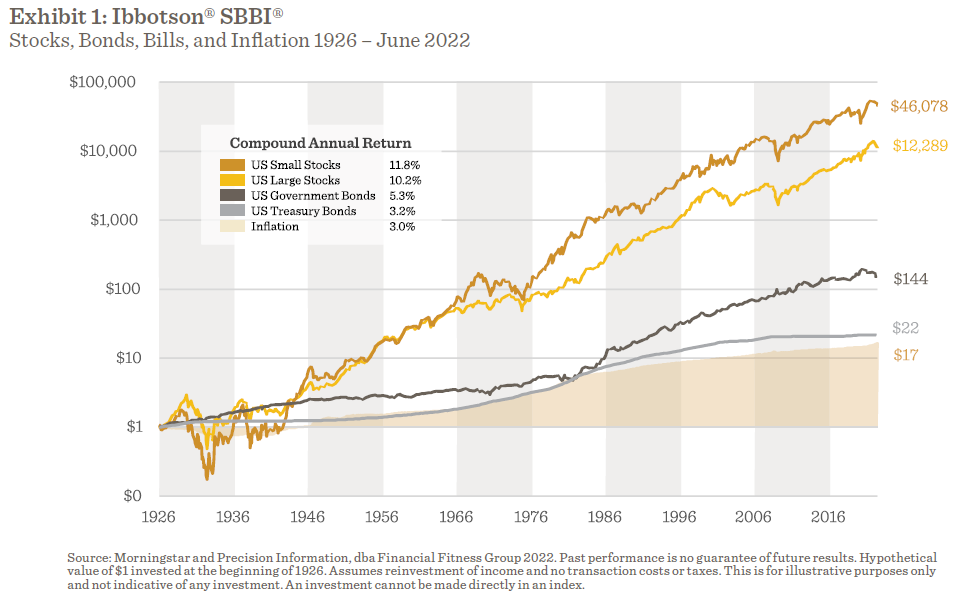

- Small-cap stocks have historically provided the best return profile in public markets.

- Style matters. While value and growth can play complementary roles in a balanced portfolio, the highest returns have typically come from value over broad economic environments.

- Research suggests that small-cap value navigates most macroeconomic regimes better than the growth style, except for periods resembling low economic growth, low interest rates, and low inflation. An economic environment that is now in the rear-view mirror.

Access the FULL REPORT.

Contact Derek Tubbs at CornerCap Institutional with any questions at [email protected] or 404-520-1447