With our commitment to institutional investment research, we are constantly evaluating our process and performance to make sure our research is the best it can be. In our conversations this year with institutional investors, the concept of “active share” has come up frequently. What is it? And where does CornerCap’s active share rank?

In this commentary, we reach two conclusions:

First, the concept of active share can be a useful (although certainly not the only) tool for evaluating whether an investment manager is likely to beat their benchmark after fees. It helps determine if a manager’s portfolio is positioned to add value, after fees, from stock picking. Active stock picking (vs. indexing) is not dead, but not all active managers are equal. We discuss the implications below.

Second, we are encouraged that CornerCap’s US stock portfolios pass the test of active share. We provide our analysis in this document.

For additional thoughts on the broader subject of active management vs. passive indexing and the impact of management fees, see our recent comment “Our Thoughts on Burton Malkiel’s Article on Active vs. Passive Investing.”

What is Active Share?

Researchers Cremers and Petajisto (2009) from Yale University created a simple, yet effective way to evaluate how close a manager’s investment holdings are to their benchmark by measuring active share. An active manager can only outperform the benchmark by taking positions that deviate from it. Active share ranges from 0% to 100% and is the percentage of the portfolio that differs from the benchmark. An active share of 100% means there is no overlap with the index and 0% would mean the manager is identical to the index.

Active Share Ranges

0% – 20% = Index Strategies

20% – 60% = Closet Index Strategies

60% – 80% = Moderately Active Stock Pickers

80% – 100% = Stock Pickers

Cremers and Petajisto track the equal-weighted performance of domestic equity mutual fund managers based on their active share from 1990 to 2003, with Petajisto extending the study to 2009. Petajisto’s (2010) results showed that only the mangers with the highest active share, called “stock pickers”, outperformed their benchmarks by gross of fees and net of fees. This held true for managers investing in small, mid and large market capitalization companies. The study also revealed a growing trend of managers claiming to be active, charging active management fees, but delivering an index-like product. If investors utilize active share, they can increase their probability of picking a manager that outperforms.

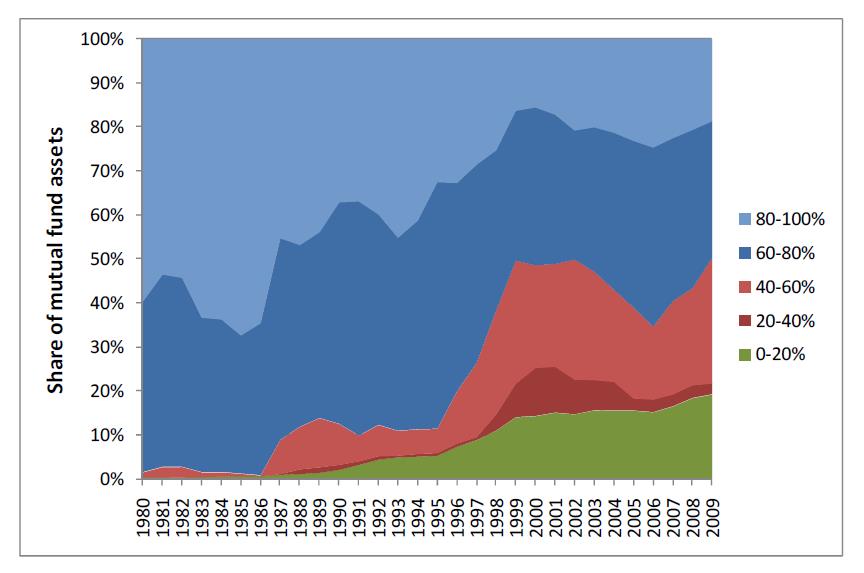

Closet indexers are funds that claim to be active and charge a higher fee for active management, but are actually mirroring an index. A manager that generates returns similar to an index, but charges higher fees, is, by design, going to underperform. Closet indexing was less than 5% of U.S. mutual fund assets in 1985 and today they have grown to over 30%. At the same time stock pickers with high active share (80-100%) have gone from 65% of assets to approximately only 20%. The growth and success of closet indexing indicates investors are content with owning underperforming mutual funds, as long as the underperformance margin is small. Have mutual fund companies and managers figured out they don’t have to bet against the index? Perhaps, as these statistics indicate, investors are willing to stay put, just don’t dramatically trail the index.

It is also common to see mutual funds move closer to closet indexing as they grow in asset size. Managers having success beating the index and experiencing large asset inflows may decide to become conservative. Why risk underperforming and losing their new-found wealth? After all, the strong performance would follow the manager for several years before rolling off.

The growth in popularity of closet indexing is a major contributor to why the average mutual fund underperforms net of fees. Performance statistics for active mutual fund management will be at a permanent disadvantage for as long as studies include closet index managers that charge active management fees. We do not expect to see the research change, since a majority of it is being produced by firms managing passive strategies, and they have no incentive to exclude closet indexers. A shrinking pool of “real” active managers means it will be harder for the average investor to succeed picking managers. However, as an active manager, we will look for opportunities to profit from ripple effects created by the increasing popularity of closet and passive strategies

Source: Petajisto (2010)

Moderate stock pickers are taking more active bets than closet indexers, and their gross of fee returns have been positive, but net of fees are still negative.

Stock picking fund managers are willing to deviate from their index, and by doing give investors the best opportunity to outperform net of fees. Unlike those in the other active share ranges, managers in this group have demonstrated their ability to pick stocks and have earned their fees.

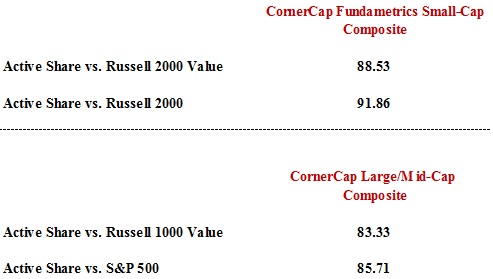

CornerCap’s domestic small-cap and large/mid-cap equity portfolios’ active shares establish it in the stock-picking group.

As of 9/30/13

Index strategies are funds with the lowest active share, which should not be seen as a negative because the objectives of these funds are transparent and investors know the fund is trying to emulate an index. A major benefit to index strategies is they charge accordingly for their management style. With the lowest fees in the industry, investors are receiving and paying for a passive management style. Mutual funds in the index category can play a role in a portfolio and CornerCap utilizes them when we want beta (market) exposure to an asset class we are not actively managing. Index funds have low tracking error, low fees and investors will not need to worry about evaluating an active manager. At CornerCap, we also take comfort from eliminating manager style drift or a sudden change in philosophy to chase a hot market trend. This historically occurs at exactly the wrong time for investors.

Summary

Is picking a successful manager really as simple as looking at active share? CornerCap’s answer is no, it is not. Active share is just one of the qualifications an active manager should meet in order to be considered. Cremers and Petajisto’s work looks at the average manager performance in each active share group; meaning there will be managers that outperform and underperform in each group. We appreciate that active share evaluates a manager’s portfolio today; after all, today’s portfolio will generate tomorrow’s returns. Too much emphasis can be put on historical statistics like tracking error, which will not alert investors to a sudden change in management style.

In investing there are very few certainties, there are investment principles that can guide investors. If beating the market through active management is a goal; analyzing active share should be included as one of the guiding principles.

CornerCap’s domestic equity products follow a value-oriented, contrarian investment discipline and are squarely in the Stock Picker category for active share, in our view. We do not believe that high active share alone will lead to out-performance, but it is a necessary pre-condition along with a repeatable, consistent and independent investment discipline. Regardless of market conditions, following a consistent discipline minimizes human emotion and should yield favorable long-term results.