After nearly 18 months of rescue packages, it is clear that Europe lacks a convincing solution to the sovereign debt and banking crisis.

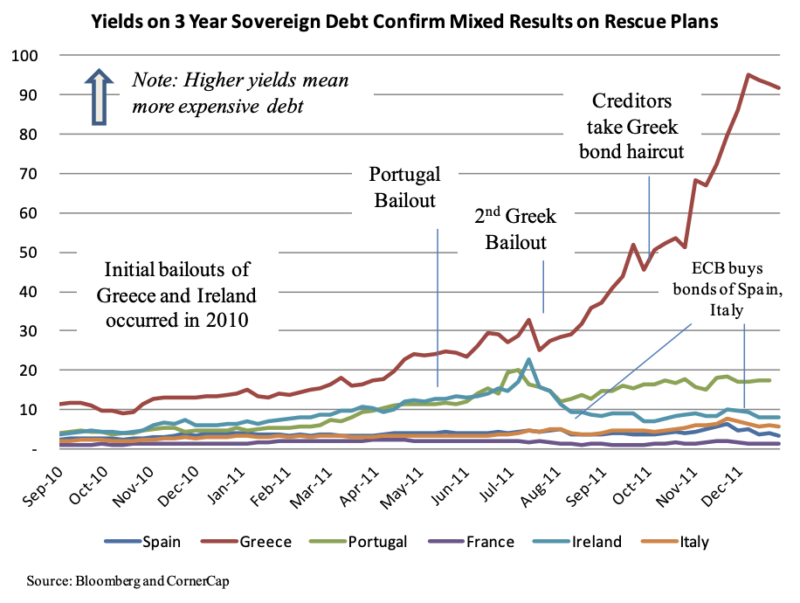

Markets know this. Bond yields (see figure below) are at or near all-time highs for Greece, Portugal and Italy, despite targeted rescue efforts. By comparison, yields on perceived-to-be-healthy sovereign nations like Germany, the UK, the Netherlands, and even France remain in good territory.

European stock markets also show extreme concern, generally down 10% to 30% in 2011. Greece was down over 50%. Most economists say recession is inevitable.

Why the skepticism? As we outlined last September (see our report Update on the European Sovereign Debt Crisis), problems won’t be solved until Europe develops a centralized, credible funding mechanism to contain the damage. Until then, several countries will have to go through painful debt restructuring and economies will contract under austerity measures. The longer it takes, the more painful it could be as debt increases. This is already happening for Greece, Ireland, Spain, Portugal and Italy (see figure below), which is why their cost of debt is trending higher.

Over the next six months, markets will be watching several key events (see figure on next page). We estimate around €200B in sovereign debt and perhaps €350B in debt and equity for banks will come to the market for funding. European credit markets remain in lock-down. These requirements could push the limits of its current funding mechanism (the EFSF), if banks or other investors don’t participate.

The Euro Summit in March will hopefully push politicians toward a more complete solution to the crisis, including moving beyond austerity measures to include pro-growth efforts, better fiscal policy integration, and granting the European Central Bank with more funding authority.

The risk to all this would be that weak funding results along the way could spread to other sovereigns or banks, causing a lack of confidence and multiple shortfalls. Also, there is potential for counterparty risk if off-balance sheet arrangements occur—i.e., a country guarantees a debt offering but then becomes insolvent themselves. This condition would have similar effects on credit markets that Lehman had in 2008, so it will be worth investigating.

We continue to recommend that investors stay with their portfolio allocation and avoid taking extreme positions (going to all cash, or highly concentrated portfolios), even with complex events unfolding. Volatility should be expected as the world works through these issues, but the appropriate investment strategy should be able to guide investors to their financial goals. Adhering to a bearish or bullish prediction on the economy or markets misses the inevitable opportunities and risks that are unfolding in unpredictable ways, and leads to “market timing,” with its dismal record. With our disciplined research and re-balancing, our goal is to balance risk/reward with fundamentals and probable outcomes to help our clients meet their long term financial objectives in an uncertain time.