Fundametrics® Small Cap Equity

4Q 2022 Performance Summary and Observations

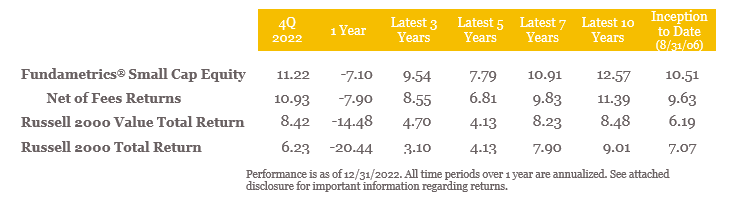

- The Fundametrics® Small Cap Value strategy finished the quarter and year with strong relative returns, beating the Russell 2000 Value Index by 280 bps for the quarter and 740 bps for the year.

- 2022 saw the Fed raise interest rates at one of the fastest clips on record, increasing the probability of pushing the US economy into a recession. Investors spent the year pricing in this risk, with small valuation multiples contracting by 29%, while trying to predict the Fed’s next move. 2023 will start with a lot of the same uncertainties, which historically creates alpha opportunities for disciplined stock pickers like CornerCap.

- The Fundametrics investment process, which emphasizes picking the best stocks within each peer group, performed well. The Alpha Composite Buys beat both the overall small cap universe and sell-rated stocks. The Financial Warnings Overlay model that helps the portfolio avoid torpedo stocks was effective identifying riskier companies.

- From a factor perspective, value, after being left for dead in previous years, continued its outperformance over long-duration growth. Investors also preferred high quality and dividend paying stocks.

- At two standard deviations below the average, small-cap P/E multiples suggest investors are pricing in significant recession risk. Since 2006, median one-year returns for the small-cap investable universe and Russell 2000 Value Index have been over 50% following these events without experiencing a down year.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117 or CLICK HERE TO DOWNLOAD

Access to full report DISCLOSURES.