Fundametrics® Small Cap Equity

3Q 2022 Performance Summary and Observations

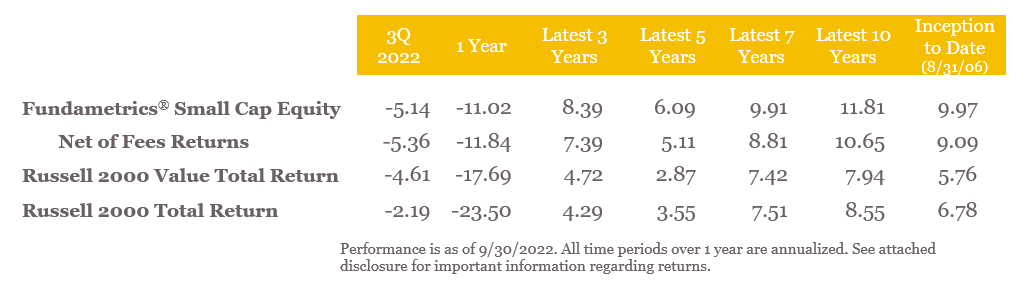

- The Fundametrics® Small Cap Value strategy returned -5.14% for the quarter, trailing the Russell 2000 Value Index’s return of -4.61%.

- The quarter started with optimism that the Fed had reached a “neutral” rate position and investors went on offense during July. This optimism was premature. Inflation numbers remained high and the labor market hot. The Fed communicated its continued aggressive stance to bring down inflation and cool the economy through higher interest rates. Stocks retreated for the rest of the quarter.

- The mainstays of the Fundametrics research process were mixed during the quarter. The Alpha Composite Buy-rated stocks beat the Sell-rated stocks. The Financial Warnings Overlay added value in August and September during the downturn, but this did not make up for the deficit created during the risk-on environment in July.

- From a factor perspective, there were contrasts during the quarter. July rewarded high beta stocks, but that quickly faded in August and September as investors sought lower risk. With interest rates rising, the quarter ended with a meaningful spread between high and low leverage stocks. Strong momentum, current growth and positive revisions continued to perform well. On the valuation front, higher valuation did outperform lower valuation, which is not completely surprising given the significant spread in favor of low valuation since 2021.

- The additional biotechnology weight added to the Russell 2000 Value benchmark in 2021 may be creating a conundrum for some managers. It was the second-best performing industry in the index at +7.0%. Earlier this year, CornerCap developed the ability to evaluate companies in this unique part of the market that now makes up over 6.5% of benchmark.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117 or CLICK HERE TO DOWNLOAD

Access to full report DISCLOSURES.