Fundametrics® Small Cap Equity

Q2 2021 Performance Summary and Observations

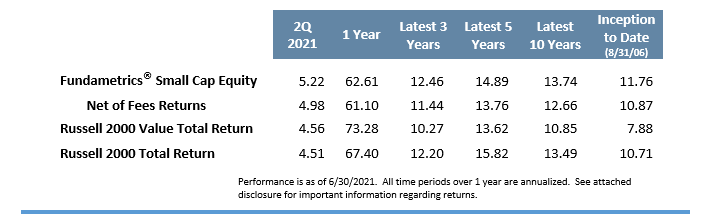

- The Fundametrics® Small Cap Value strategy returned 5.22% for the quarter vs. the Russell 2000 Value Index return of 4.56%.

- Similar to the 1st quarter, markets oscillated between style extremes. The Fundametrics research process worked well in April and May when there was an emphasis on Fundamentals. The Fed meeting in June sparked a change in sentiment resulting in a market that mirrored January’s trends: market leadership from unprofitable / negative free cash flow generators and companies with long-term growth and high short interest.

- The mainstays of the Fundametrics research process were positive for the quarter. The Alpha Composite “Buy” rated stocks beat “Sell” rated stocks by 439 bps. The dislocation in short term fundamentals still warrants an overweight to long-term characteristics in the Alpha Composite. This tilt is expected to be removed in the 3rd quarter as we anniversary the impact of the pandemic on trailing fundamentals.

- The Financial Warnings Overlay produced mixed results. “Safe” stocks beat the “Fail” group by 140 bps but trailed the “Avoid” group. The outperformance of the “Avoid” group came in the month of June, when high short interest and “meme” stocks returned to favor.

- We do believe the market is overreacting to the Fed’s most recent comments on the economy. With continued strong economic growth, the most likely path for interest rates is higher from current levels, a scenario historically favoring small-cap stocks.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.