While the daily drama unfolds in unpredictable ways, the big picture about Greece is that its economy is not structured to support its national debt. That means to us that a Greek default is inevitable. Its debt must be restructured.

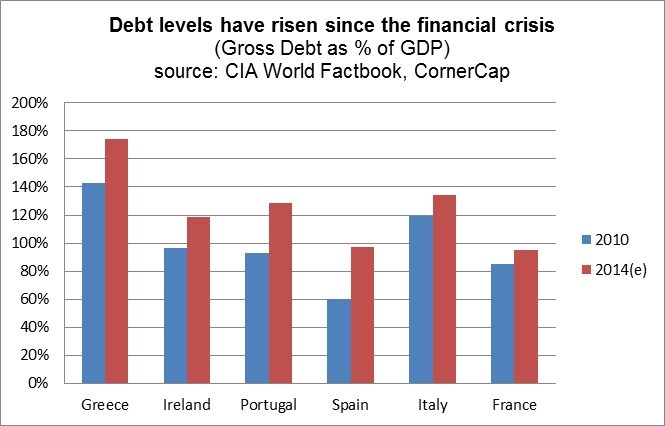

Can other nations default? Yes, and they should. Despite bailouts, national debt levels for the riskiest countries have all increased (see chart) and deficits are still negative. There’s not enough GDP growth.

Importantly, the markets have learned that certain debt restructurings don’t have to be all bad news. They just have to be predictable. Greece is going through a managed default. Spain and Portugal are not far behind.

What about a GreXit from the European Union? As we have written for years, the European Union will likely reconstitute itself. Some countries (like Greece) may need to exit because they cannot integrate economically and because they need a flexible currency. What emerges should be a smaller, more fiscally integrated Union.

The key point from an investor’s perspective is that many of the defaults are predictable and the necessary steps to a better Union are clear. Capital markets have been able to reduce their exposure to the riskiest nations. Policy makers have had ample time to contain the damage and inch toward solutions.

Sustaining confidence in the credit markets is the key to containing damage and managing risks of bigger countries like Italy or France. These countries are solvent but must also control budgets and labor costs to service their debt.

Reforming the European Union won’t be easy. It will require better political and economic integration, and we can already see how hard it is for sovereign nations to give up sovereignty. (Greece vs. Germany, for example). Time is required, and effective signaling by policy makers can buy them more of it.