Fundametrics® International Small Cap Equity

4Q 2022 Performance Summary and Observations

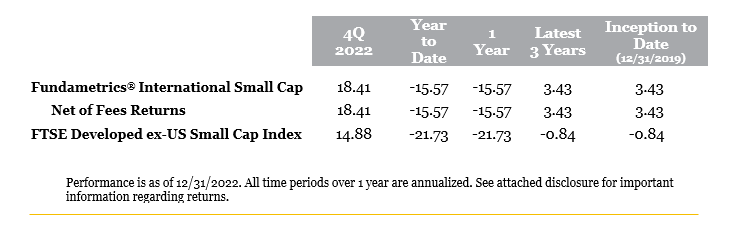

- The Fundametrics International Small Cap Equity strategy returned 18.41% for the quarter, leading the FTSE Developed ex-US Small Cap Index return of 14.88%.

- International developed markets ended the year on a high note with all major regions posting double-digit gains during the quarter after signs that inflation may be weakening. Strength in the US dollar has been a headwind for the last couple of years, but we may have seen its peak. Dollar weakness played a significant role in the fourth quarter and helped push international returns ahead of the S&P 500 for the year.

- With recent relative strength and attractive relative valuations, international markets should be a talking point. After a decade of underperformance, allocators are likely underweight international markets, especially small caps.

- The winning factor profile bounced around during the quarter, but the one constant was low valuation—a staple of the strategy—leading to a 100%-win rate across regions during the period.

- Alpha Composite model results were strong for the quarter. The Buys (+19.6%) beat Sell-rated stocks (+16.7%). The Financial Warnings overlay results were mixed.

- The end of 2022 marks the third anniversary for the International Small Cap strategy. The Fundametrics process has translated well outside of domestic markets into this less efficient asset class, as the investment team expected.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117 or CLICK HERE TO DOWNLOAD.

Access to full report DISCLOSURES.