Fundametrics® Small Cap Equity

Q2 2022 Performance Summary and Observations

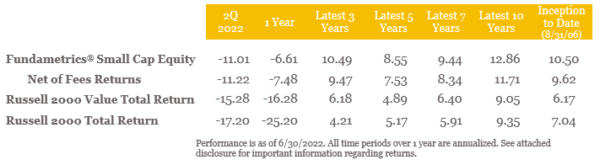

- The Fundametrics® Small Cap Value strategy performed well in a volatile market where persistently high inflation and a Fed playing catch up have increased the odds of a recession. The quarterly return of -11.01% beat the Russell 2000 Value Index’s return of -15.28% by 427 bps.

- The mainstays of the Fundametrics research process were strong during the quarter. The Alpha Composite “Buy” rated stocks beat “Sell” rated stocks by over 1200 bps. The Financial Warnings Overlay identified higher risk stocks during the downturn. The “Safe” to purchase stocks beat the “Fail” group by over 500 bps

- Stock selection is typically the main driver of excess returns relative to the benchmark and it was positive in 8 out of 11 sectors and accounted for 92% of excess return this quarter.

- From a factor perspective, the quarter was defined by two primary themes. First, during April and May, rising long-term rates continued to punish high valuation growth stocks with low valuation outperforming. Second, as recessionary fears took hold, investors turned to the defensive playbook in June with low beta, low risk, and dividend yield leading.

- Price to Earnings valuations contracted 17% during the 2nd quarter to a level 2 standard deviations to the downside. This implies the market has already priced in significant risk of recession.

- Russell reconstitution resulted in substantial changes to the Russell 2000 Value Index. Energy weight decreased by 486 bps with the biggest increases to Health Care, Consumer Discretionary, and Financials.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.