Fundametrics® Small Cap Equity

Q1 2022 Performance Summary and Observations

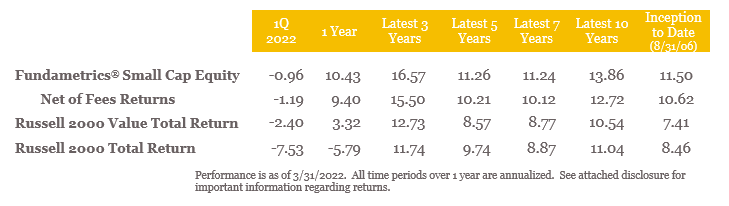

- The Fundametrics® Small Cap Value strategy performed well in a volatile start to the year, returning -0.96% for the quarter, beating the Russell 2000 Value Index’s return of -2.40% by 144 bps.

- The mainstays of the Fundametrics research process were strong during the quarter. The Alpha Composite “Buy” rated stocks beat “Sell” rated stocks by over 800 bps. The Financial Warnings Overlay identified higher risk stocks during the downturn. The “Safe” to purchase stocks beat the “Fail” group by over 340 bps.

- Stock selection is typically the main driver of excess returns relative to the benchmark and it was positive in 8 out of 11 sectors this quarter.

- From a factor perspective, the quarter started very differently than it ended. The narratives around interest rates and inflation are having big impacts. Rising long term rates punished growth stocks with value outperforming the first two months of the year. Fed commentary and commodity inflation reversed that trend as investors looked for growth in March.

- The CornerCap investment team has been busy in research and development creating a new peer group: unprofitable Biotech. This is a result of the increase of over 500 bps in the Russell 2000 Value Index’s healthcare weight, 380 bps of the increase was unprofitable Biotech (total 5.8%), at the June 2021 reconstitution.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.