Fundametrics® Small Cap Equity

Q1 2021 Performance Summary and Observations

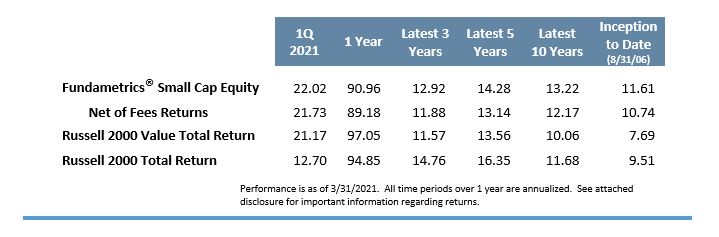

- The Fundametrics® Small Cap Value strategy returned 22.02% for the quarter vs. the Russell 2000 Value index return of 21.17%.

- Risk seeking may have peaked in January with GameStop Corp. making national headlines. While stocks with high short interest hit euphoria in January, they have been positively impacting index performance since mid-2020. In fact, high short interest sits atop our factor list as best performing for the trailing 2 and 3 quarter periods. It is a factor we are significantly underweight relative to the benchmark.

- The quarter was not defined by what happened in January and the February / March period offered a more balanced view of what we believe the future holds. Our process did not perform well in the January period in a market led by unprofitable companies and risk seeking. We did perform well once profitability and fundamentals were rewarded.

- The mainstays of the Fundametrics research process got stronger as we moved through the quarter. The Alpha Composite “Buy” rated stocks beat “Sell” rated stocks by 1050 bps, a testament that fundamentals are beginning to matter. The current dislocation in short term fundamentals has warranted an overweight to long-term characteristics in the Alpha Composite, which helped us during the quarter.

- The Financial Warnings Overlay detracted from portfolio returns for the quarter. “Safe” stocks trailed the “Avoid / Sell” group by 890 bps, which was primarily caused by the risk seeking rally in January. However, for the remainder of the quarter, the Overlay did provide a positive impact.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.