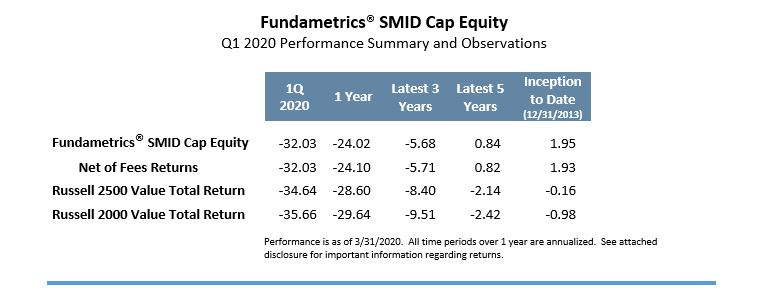

Fundametrics® Smid Cap Equity

Q1 2020 Performance Summary and Observations

- The market experienced historic dislocation this quarter, but our relative performance was solid (ahead by 261 bps vs. the Russell 2500 Value) and our models behaved as we would expect.

- Our customized peer groups and our financial warnings risk overlay (both developed since the Financial Crisis in 2008) played major roles behind our favorable results in this very challenging market, which included extreme volatility, downward but uneven earnings revisions, and high uncertainty. In contrast, valuation created a partial headwind to our results.

- Unsurprising during the fallout, factor leadership was dominated by “Low Vol” characteristics. What was surprising from a factor perspective: “Best Stock Price Momentum” also performed well. That style is not typically a consistent leader in times of stress.

- The setup for valuation looks favorable going forward. We have not seen this type of dislocation since 2008, as sector neutral valuation spreads hit 3 standard deviation-levels during the quarter.

- Our research indicates that what has worked during the downturn (Low Beta, Low Vol, Momentum) will likely lag when a sustained rebound occurs, implying that valuation and higher beta stocks will offer the better profile for returns in the coming year. The portfolio has been adding exposure to these areas.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.