In our investment research, we love coming across new ideas and information that provide insight into human behavior and investment success. The image below highlights two very important points that we would like to share.

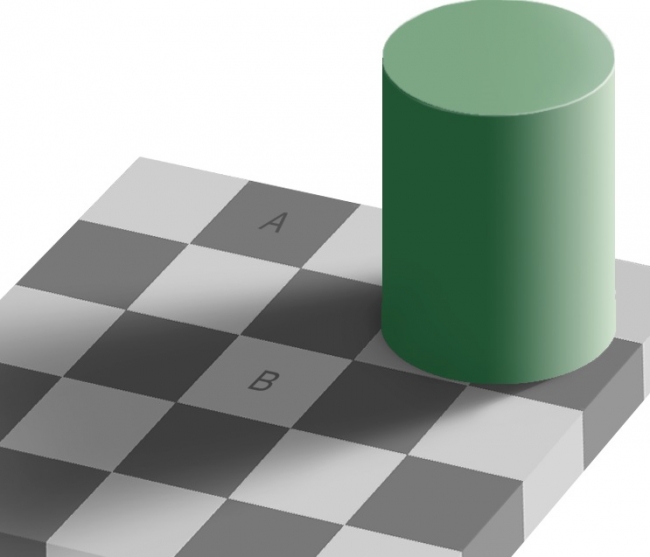

Look closely at the image. Of the two squares marked “A” and “B”, which is the darker square?

The answer is obvious, no? Square A clearly looks darker than B, with no room for debate. In fact, for many of us, our confidence level might be so high that we would never think twice about the decision, and we might even make a handsome bet that we were right.

Squares A and B are actually the same color. Why are we fooled? The surrounding colors of the two squares plus the effect of the cylinder’s shadow trick us into drawing a false conclusion.

We will admit that we didn’t believe this illusion at first. So we verified it independently, using two different software tools to test the pixel color of the two squares. We found that they have the same pixel parameters.[1]

What does this have to do with investing?

First, it’s a great reminder that people bring inherent biases when making investment decisions. Some are famously obvious—like herd mentality, or overconfidence—while others are dangerously subtle—like anchoring bias, or framing. To counter this inevitable bias, we need an approach and process that arrives at a decision systematically and objectively. It must see through the tricks and biases as best as possible. For this image, if we evaluated the squares based on the proper pixel parameters (RGB codes or HEX codes, for example), we would not be tricked by misperception.

In poker, they say that if you are at the table and you don’t know who the chump is, then you are the chump. We like to say that in investing, if you don’t think bias creeps into your decisions, then you are the chump.

Second, this illusion shows how easily people can be tricked into making the wrong decision. The investment industry is well known for preying on human emotion to convince investors to buy products or services they don’t need, or to behave in a way they shouldn’t.

Our colleague Walker Davidson calls this “the art of paying attention”, and he is exactly right.

In fairness, a scientific or objective process is not always correct either. But our point is that, when making decisions, people understandably rely on their physical senses, experience and judgment. The illusion above is a great illustration of how biased decision-making can be.

For details on our investment process, which strives to minimize human bias and emotion, visit .

[1] Both squares have an RGB code of R: 120 G: 120 B:120 and HEX code of 787878. By way of background, the RGB system constructs colors from some combination of red, green and blue. HEX codes, often used in computer programming, represent another way of representing colors in a spectrum.