Fundametrics® Small Cap Equity

Q4 2021 Performance Summary and Observations

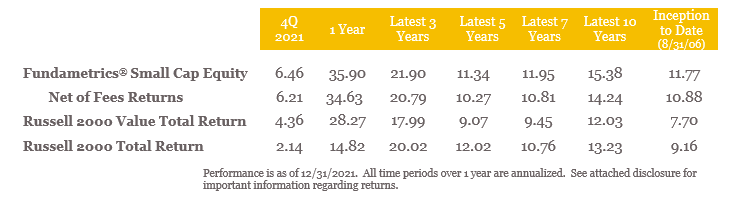

- The Fundametrics® Small Cap Value strategy finished the year strong, returning 6.46% for the quarter, beating the Russell 2000 Value Index’s return of 4.36% by 210 bps.

- Small Cap Value as an asset class emerged as the leader for 2021 beating out Large Cap stocks and dominating Small Cap Growth. The Russell 2000 Value Index beat the Russell 2000 Growth by over 2500 bps!

- Omicron initially derailed the small-cap upside break out of the 3rd Expectations are that Omicron is less severe and the economy will be able to bounce back quickly. With continued strong economic growth, the most likely path for interest rates is higher from current levels, a scenario historically favoring small-cap stocks.

- The mainstays of the Fundametrics research process were positive for the quarter. The Alpha Composite “Buy” rated stocks beat “Sell” rated stocks by 1000 bps

- Stock selection is the strength of the investment process, and it was positive in 8 out of 11 sectors.

- Companies with strong fundamentals performed well during the quarter with the unprofitable growth group underperforming. This is evident in the factor leadership for the quarter, rewarding high quality, low valuation, and positive changes in estimates. Stocks with the highest valuation, low quality and high forecasted long-term growth lagged. If the path of interest rates is higher, this environment likely continues.

- A meme stock now has the biggest weight in the Russell 2000 Value index. AMC Entertainment remains the top position and Avis Budget Group is now a top 5 position.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.