Fundametrics® Small Cap Equity

Q4 2020 Performance Summary and Observations

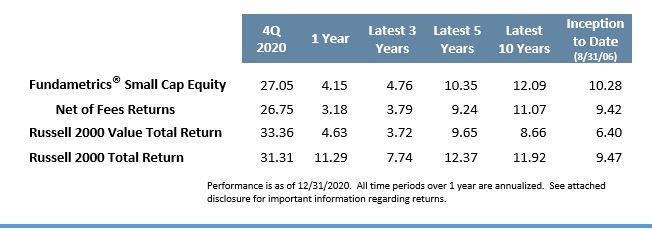

- The Fundametrics® Small Cap Value strategy returned 27.05% for the quarter, vs. the Russell 2000 Value index return of 33.36%.

- The quarter was defined by what happened after the announcement of a vaccine in early December. Risk seeking got a tail wind and rewarded stocks with controversy, leverage, high beta, and the weakest profitability profiles.

- Higher quality companies suffered, where unprofitable companies outperformed profitable ones by over 1300bps in the quarter. This year has been defined by the tails, whether pure growth or deep value; being in the middle has meant trailing the index.

- These trends worked against the Fundametrics research process. Sell-rated stocks in the model were heavily skewed toward companies with poor quality metrics and expensive fundamentals; these poorly ranked stocks beat the “Buys” by over 1100 bps.

- Value style attributes for the quarter generally fared better than many growth and momentum factors. However, within the Valuation style results were mixed, with deep value and longer-term valuation factors faring better than current valuation factors.

- Engrained in the firm’s DNA is to continually challenge assumptions and model construction with thorough research and development. In the past, this has resulted in the development of defining characteristics of Fundametrics like the Financial Warnings Overlay and CornerCap defined Peer Groups. The research team is currently evaluating market environments where current fundamentals are experiencing significant dislocations from future expectations and how to better evaluate stocks during these temporary shocks.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.