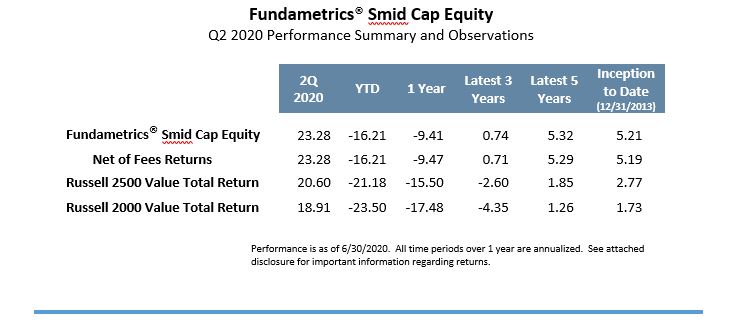

Fundametrics® Smid Cap Equity

Q2 2020 Performance Summary and Observations

- Markets in 2020 are exhibiting extremes in volatility, returns, and factor leadership, yet the strategy is proving effective at navigating these diverse environments. After favorable relative results in 1Q, the composite outperformed the Russell 2500 Value Index in 2Q by 268 bps.

- As we discussed last quarter, the factors that led in the downturn are not likely to be the leaders once a sustained recovery happens. While we cannot yet call “the turn,” we did see the reversion we would expect as hopes for recovery emerged: low volatility, low beta, and high momentum receded to higher beta and mixed quality. Notably, valuation spreads remain mixed.

- The mainstays of the Fundametrics research process were also mixed. The Alpha Composite Buy-rated stocks beat our “Hold” rated stocks but trailed our “Sell” rated stocks. The Financial Warnings Overlay, which helped navigate the downturn in 1Q, offset that benefit during the rebound; this often happens in the early stages of recovery, when lower quality stocks can surge.

- As the market marched higher, we saw an ongoing back and forth between the Value and Growth styles, with little middle ground. Value did well on favorable expectations for the economy, and Growth led when sentiment became more cautious on the pace of recovery.

- While this tug-of-war between styles may continue until the pandemic gets under control, we note that the setup for valuation continues to look favorable. Even after the strong 2Q return, sector neutral valuation spreads remain between 2-3 standard deviation-levels in favor of value.

Contact Derek Tubbs at CornerCap Institutional for the full report: 404-445-5117.

Access to full report DISCLOSURES.